Via this Cato white paper, I submitted the following recommendations to the “Department of Government Efficiency,” a private-sector organization that will advise President-elect Donald Trump on how to reduce inefficiency in the federal government. The following recommendations would achieve the Democratic goal of limiting the tax exclusion for employer-sponsored health insurance and the Republican goal of giving workers greater control over their health care dollars and decisions, all in a manner that is budget-neutral and more politically durable than past efforts. I further submitted recommendations relating to federal health spending and federal regulatory policy. The three sets of recommendations operationalize the reforms I propose in my latest book, Recovery: A Guide to Reforming the U.S. Health Sector (Cato Institute, 2023).

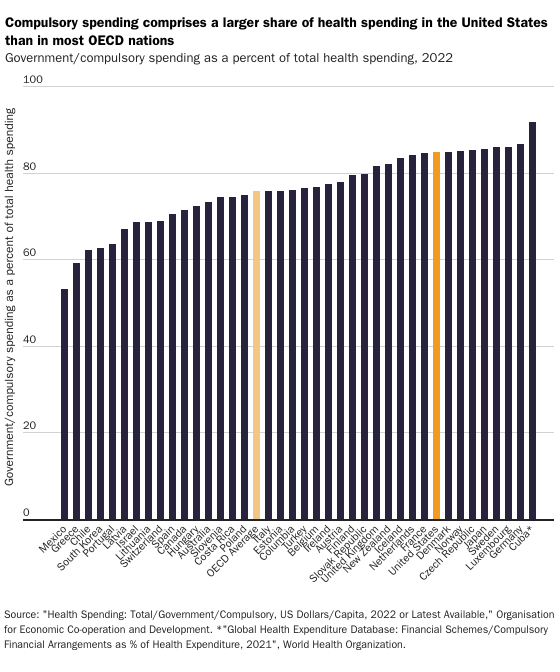

In a free market, consumers would control 100 percent of health spending. The government would control 0 percent. In the United States, the government controls 84 percent of health spending. That’s one of the highest shares among advanced nations. It’s just 5 percentage points behind communist Cuba. The result is that the health sector does what the government and special interests want—not what consumers want.

At more than $1 trillion per year, the largest source of compulsory health spending is employer-sponsored health insurance. The federal tax code effectively compels workers to let their employers control a sizeable chunk of their compensation, about $18,000 of the average family’s earnings, and their choice of health plan.

This regressive policy makes health care less universal. It increases health care prices by reducing price competition. It reduces health care quality by penalizing delivery innovations, such as electronic medical records and care coordination. It reduces health insurance quality by compelling workers to purchase coverage that predictably and routinely disappears after patients get sick, leaving them with uninsurable preexisting conditions. These burdens fall hardest on the most vulnerable patients.

Tax-free universal health accounts (UHAs) would return that $1 trillion to the workers who earn it and restore workers’ freedom to make their own health decisions. UHAs would make health care more universal—better, more affordable, more equitable, and more secure.

The federal government should do the following:

- Replace all health-related tax preferences with a single income- and payroll-tax exclusion for deposits into worker-owned, tax-free UHAs.

- Set UHA deposit limits for individuals and families at levels that achieve revenue neutrality.

- Allow patients to use UHA funds to purchase any health insurance plan from any source, tax-free.